A Remarkable Coincidence in Wave Executive Trading

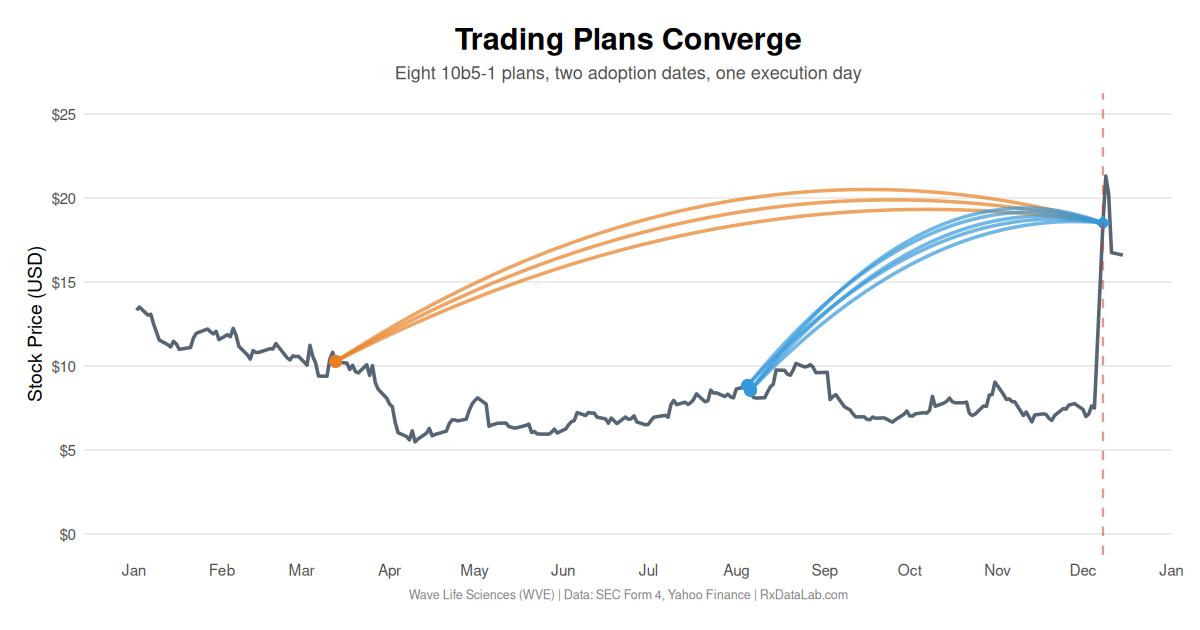

Eight Wave Life Sciences executives adopted 10b5-1 trading plans in two clusters months apart, and all eight plans executed on the day of a clinical trial announcement.

On December 8, 2025 Wave Life Sciences announced positive interim results from a Phase 1 trial for their novel siRNA based obesity treatment WVE-007. The treatment was reported to show promise for weight loss without the loss of lean mass associated with GLP-1 family drugs. Following the announcement, their stock jumped from $7 at the beginning of December to $18.50 on December 8, and peaking (so far) at $21.31 on December 9.

What caught my eye was an unusual pattern in the Form 4 filings that followed.

Eight Execution Dates Converge #

On December 8, eight Wave directors and executives filed Form 4s disclosing stock sales totaling more than $15 million. All eight sales were executed pursuant to 10b5-1 trading plans — pre-arranged agreements intended to provide an affirmative defense against insider trading allegations.

Five insiders adopted their plans on August 5 and 6, 2025, while three others adopted plans on March 13, 2025. Despite these adoption dates being separated by nearly five months, all eight plans executed on the same day: December 8, coinciding with the public announcement of interim WVE-007 trial results.

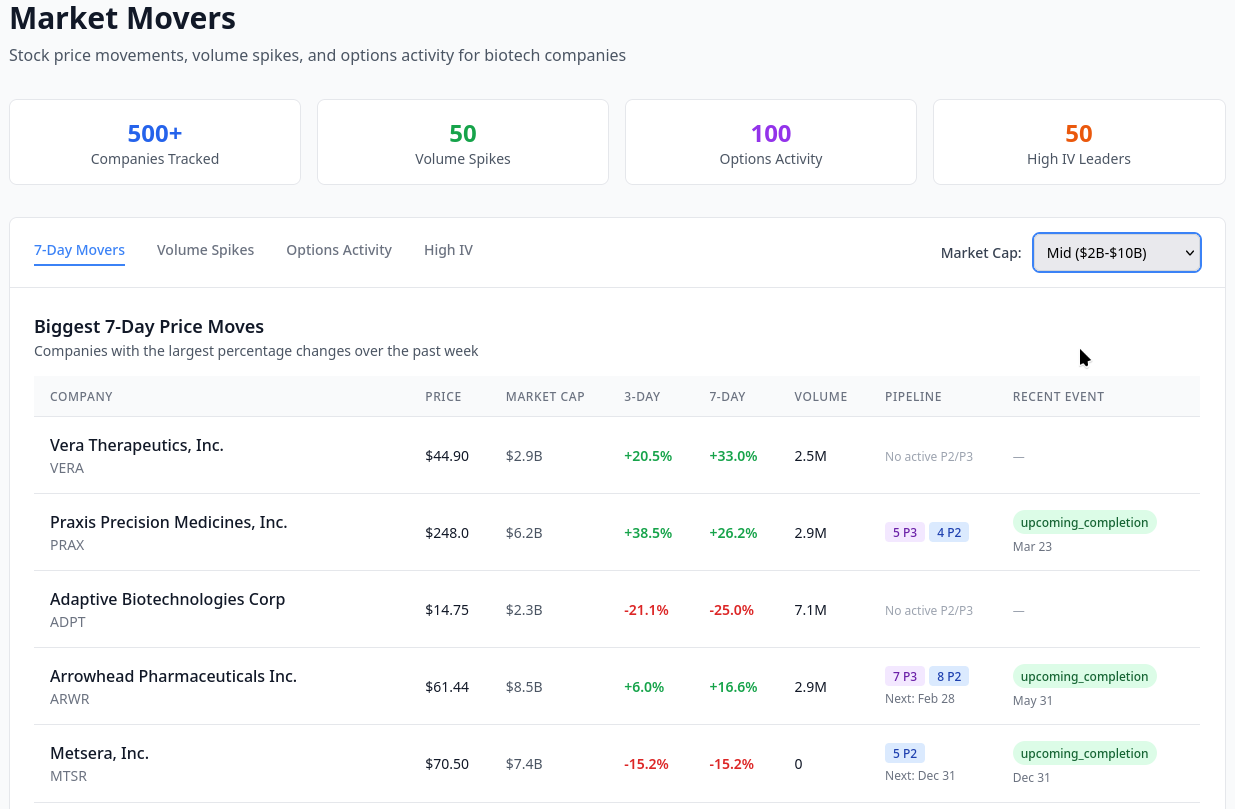

Trading Plans Converge

Trading Details

The chart above shows Wave’s stock price over time, with overlays for SEC 8-K filings and insider trading activity. Each arc represents a 10b5-1 plan, connecting its adoption date to its execution date. Data spans from 2024 through December 2025.

The specific terms of 10b5-1 plans are not publicly disclosed. While Form 4 filings indicate when a plan was adopted, they do not reveal whether executions were governed by fixed dates, price-based triggers, or other mechanical formulas. As a result, I don’t know the precise mechanism that caused all eight plans to execute on December 8- though price-based execution thresholds offer a plausible explanation.

What Was Publicly Known #

It’s useful to consider what information was available at each plan adoption date.

- When three insiders adopted plans on March 13, 2025, Wave had just released Q4 2024 financials nine days earlier.

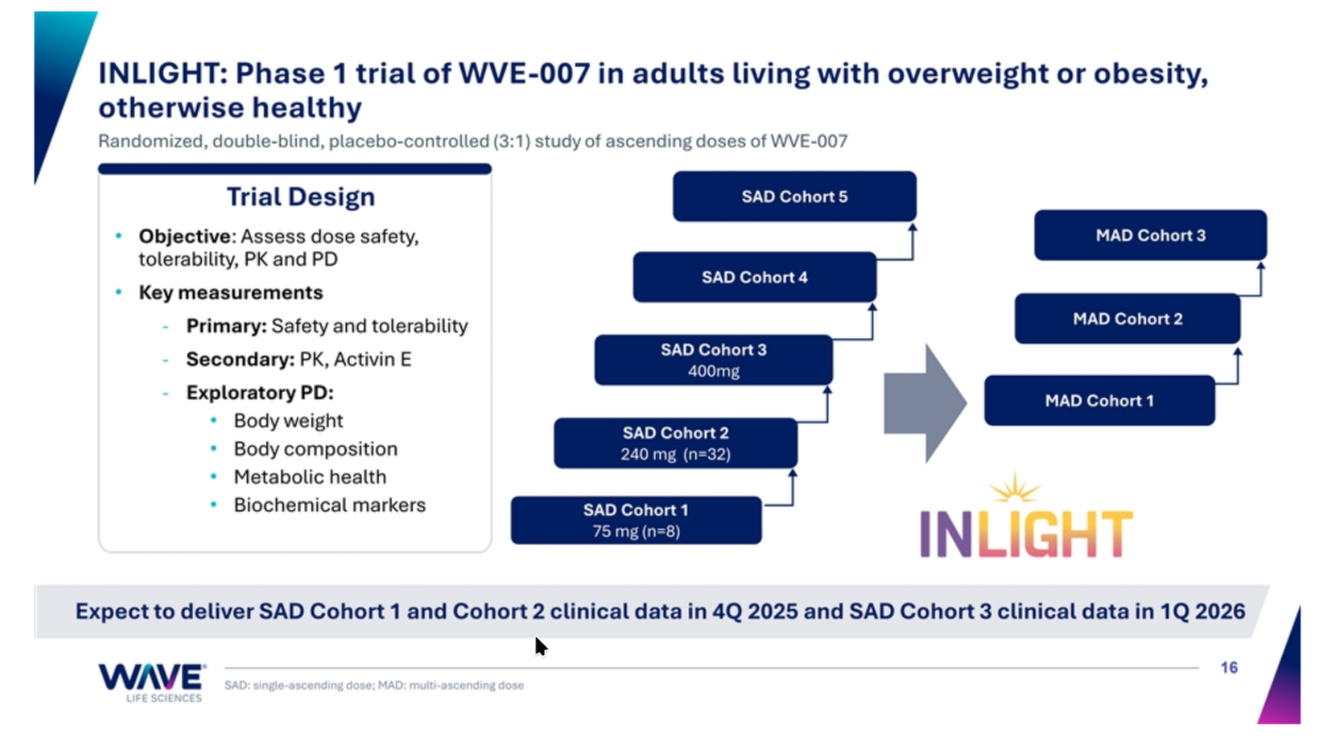

- In May 2025, Wave updated an investor presentation indicating WVE-007 trial results would come in the second half of 2025.

- On July 30, 2025, Wave released Q2 2025 financial results.

- One week later, on August 5, Wave filed an updated investor presentation that narrowed the readout timeline, projecting that WVE-007 data for cohorts 1 and 2 would be released in Q4 2025, with cohort 3 following in Q1 2026. The company also announced an amendment to their stock-based compensation policy.

- Between August 5 and 6, five executives adopted 10b5-1 plans.

- Wave reiterated the Q4 2025 cohort readout in their Q3 earnings release on November 10

- Wave issued an updated corporate deck on November 17, referencing expected cohort data readout in the fourth quarter.

Industry Context #

The specific terms of 10b5-1 plans are not publicly disclosed. Form 4 filings indicate when a plan was adopted but not whether trades are scheduled by fixed dates, price thresholds, or other mechanical triggers. As such, the December 8 executions could plausibly reflect price-based thresholds reached during the post-announcement rally.

What caught my eye about this case was not any single trade, but the convergence. Five executives adopted plans within a two-day window in early August and three others adopted plans nearly five months earlier in March. Despite these staggered adoption dates, all eight plans executed on December 8, coinciding with the public release of positive interim trial data.

In biotech, companies often know trial outcomes well in advance of disclosure while data are analyzed, validated, and prepared for release. 10b5-1 plans are designed to distance trading decisions from that information. When multiple plans adopted months apart converge on a single execution date tied to a major clinical catalyst, it raises a question: how common is this degree of synchronization throughout the industry?