Eikon Therapeutics Talks Platforms but Bets Big on Acquired Oncology Assets

Eikon Therapeutics develops small molecule therapeutics by tracking protein behavior in living cells, with a focus on oncology and immunology. The company was founded by pioneers in super-resolution microscopy, particularly single molecule tracking (SMT), alongside experienced biotech executives.

Eikon claims to use proprietary SMT microscopes and custom software to screen protein-ligand interactions in live cells, generating large, high-dimensional datasets. In its own marketing, Eikon emphasizes automation, machine learning, and a platform-based approach to drug discovery.

Despite these claims, Eikon’s current pipeline reflects a narrower focus on oncology assets it has acquired. The lead compound, EIK1001, a TLR7/8 co-agonist licensed from Seven and Eight Biopharma is in trials for non-small cell lung cancer (NSCLC) and melanoma.

This brief report examines the company’s funding history, clinical activity, and strategic positioning.

Eikon Fundraising ¶

According to SEC Form D filings, Eikon has raised more than $1 billion across four funding rounds.

Each round drew between 12 and 43 investors. The January 2022 round had the most (43), while the May 2021 round had the fewest (12). Notably, the June 2023 filing shows that Eikon raised only 26% (~$140M) of its ~$535M target from 21 investors. The most recent round, disclosed in early 2025, shows a rebound: $350M raised out of a $400M target from 27 investors.

Form D filings provide point-in-time snapshots and often miss follow-on investments. However, Eikon has not filed any amendments, and multiple third-party databases agree with the reported totals, suggesting the filings represent a reliable approximation.

Clinical Pipeline: Trial Terminations and Reset ¶

Eikon’s weak fundraising in mid-2023 coincided with two quietly failed trials involving BDB001 (now EIK1001):

Each trial planned to enroll dozens of patients but ultimately reported just one participant enrolled before being marked as “Completed.” We classify these as de facto terminations.

Since then, Eikon has reset its clinical pipeline to focus on three solid tumor candidates:

- EIK1001 (BDB001) – Acquired from Seven and Eight Biopharma

- EIK1003 (IMP1734) – Licensed from IMPACT Therapeutics

- EIK1004 (IMP1707) – Also from IMPACT Therapeutics

The company’s recent job postings reinforce this shift. Since March 2025, most new roles have focused on clinical operations, particularly director- and senior-level hires aligned with existing oncology programs.

A Revolutionary Platform—Still in Development? ¶

Eikon has engineered a next-generation drug discovery engine that seamlessly integrates automation, high-performance computing, and advanced data science…

— Josh Wolfe, Lux Capital (Source)

That vision may eventually prove out, but the current pipeline does not reflect drugs developed from Eikon’s in-house platform. The only candidate that appears internally developed is EIK1005, a WRN inhibitor that is not yet in trials.

Eikon’s recent patent filings suggest platform development is ongoing, including:

- WRN helicase inhibition

- SMT analysis via graph neural networks

- Instrument calibration and assessment algorithms and methods

In July 2024, Eikon published a WRN inhibition paper that integrates SMT data, indicating some platform use. The company expects EIK1005 to enter Phase 1 trials in the first half of 2025.

Conclusion ¶

Eikon has built a compelling narrative around data-rich discovery and cutting-edge imaging, but its clinical programs have leaned heavily on externally sourced compounds. While recent activity around WRN and SMT-based analysis hints at platform traction, investors and observers should watch closely to see if EIK1005 and other undisclosed candidates can validate Eikon’s technology thesis.

We’ll continue to track companies like Eikon that claim platform-driven advantages but face real-world development pressures.

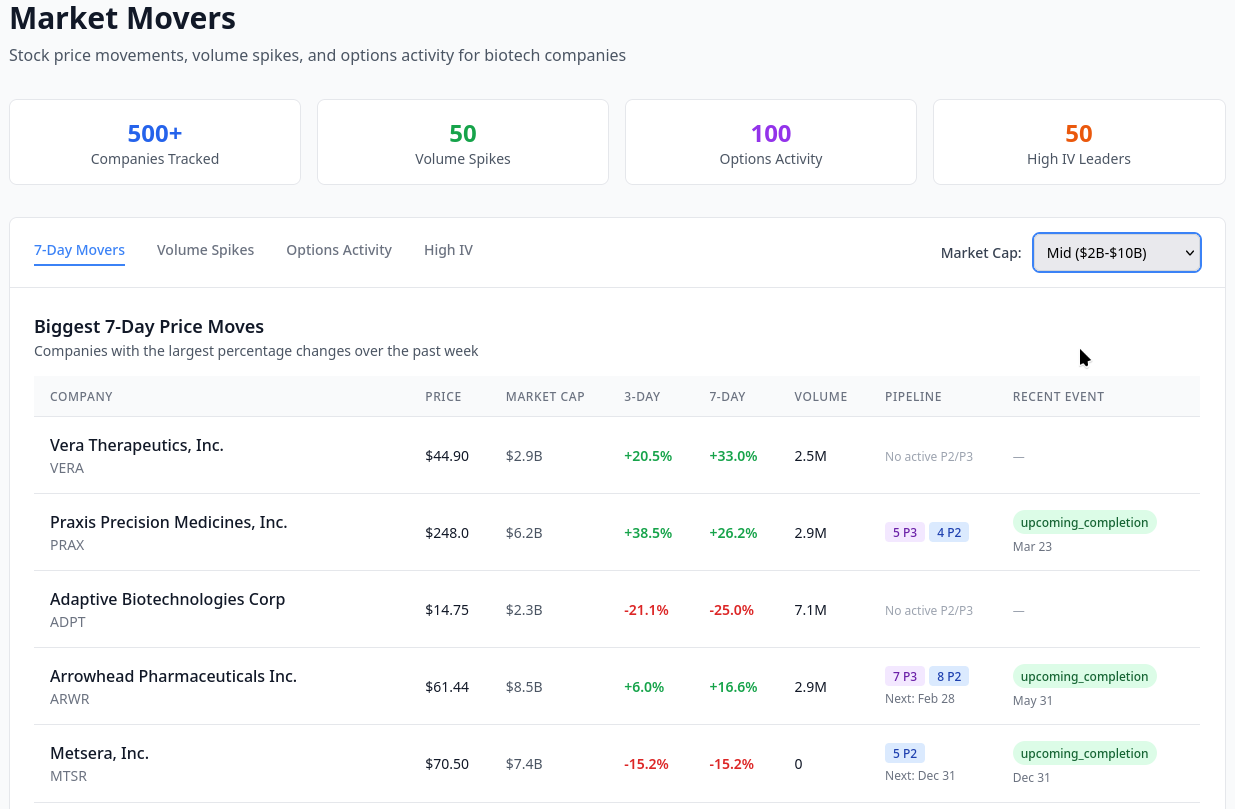

Clinical Trial Tracker

NEWTrack biotech pipelines, trial changes, and market movements in one platform. Company-first organization, automatic change detection, and your research notes connected to live data.